Looking for something?

RNAi: The Persistence of a Few Leads to Success

On August 10, 2018, the U.S. Food and Drug Administration (FDA) approved the first RNAi therapy. The approval marked a significant milestone not just for the drug but the entire field of RNA interference (RNAi). The success of the technology was never guaranteed, and a tumultuous period where Big Pharma companies started selling off their RNAi assets heralded what many believed to be the end of RNAi therapies. Now, five years later, several more drugs using RNAi technology have received approval and act as life-saving treatments for patients, and pharmaceutical companies are rapidly investing back into the RNAi field, and siRNA therapeutics in particular.

The ups and downs of RNAi technology

In 2014, big pharma had grown skeptical of the success of RNAi. Following problems with serious side effects, patient deaths during several clinical trials, and the ongoing challenge of cell-specific delivery, companies began exiting the field, despite having spent billions of dollars pursuing the first generation of RNAi drugs.

When pharmaceutical company Roche announced their exit from in-house RNAi therapeutics development in 2010, it “sent shockwaves through the industry” (1). The company had invested heavily in the technology only a few years prior, but their decision to sell off assets, including delivery technologies, three primary siRNA formats, infrastructure, and personnel, to Arrowhead Pharmaceuticals was seen as many others in Big Pharma as a vote of non-confidence in RNAi. Roche cited problems with cell-specific delivery, and amidst similar challenges, Novartis exited the RNAi game in 2014, selling its RNAi portfolio to Arrowhead. Pharma giant Merck also sold their RNAi assets, including patents and technology, to Alnylam in 2014, despite having acquired these assets from Sirna Therapeutics in 2006 for $1.1 billion. Pfizer and Abbot Labs also terminated their RNAi in-house development (1).

As large pharmaceutical companies increasingly chose to exit RNAi development due to the delivery challenge, the resolve and work of companies like Alnylam and research teams focused on siRNA, including the Khvorova Lab led by Dr. Anastasia Khvorova at UMass Medical School, the Corey Lab, led by Dr. David Corey at UT Southwestern Medical Center, and the Damha Group, led by Dr. Masad Damha at McGill University, kept reinforcing the foundations of the field. In 2018, Alnylam’s siRNA-based drug patisiran was the first RNAi therapeutic to receive FDA approval, and now a renewed interest in RNAi has begun.

“While other companies started to exit the field, we continued to believe in the life-changing benefits of RNAi, and that persistence has paid off,” said Barry Greene, President of Alnylam until 2020.

“The approval of the first RNAi therapeutic was a major scientific milestone, not only for Alnylam but for the entire field. RNAi represents an entirely new way to treat disease,” Greene added. “It has the potential to bring hope to tens of thousands of patients around the world living with genetic and rare diseases that were once thought to be untreatable.”

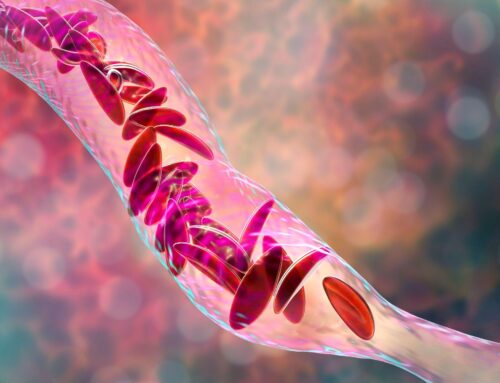

Patisiran — the first RNAi drug approved — blocks the faulty production of transthyretin, a protein that accumulates and damages the nervous system in people with hereditary transthyretin-mediated amyloidosis (hATTR). Before Patisiran’s approval, the only treatment option for some patients was a liver transplant.

Big Pharma re-enters the RNAi sphere

In addition to the FDA approval of the first RNAi therapy, drug developers’ revived interest in RNAi can be credited to advancements in generating, purifying, and delivering RNA material and addressing obstacles with degradation by enzymes. Additionally, the relatively cheaper and straightforward manufacturing and ability to reach drug targets previously inaccessible by small molecules has a string of pharma companies re-entering the RNAi sphere.

In 2019, Novartis acquired The Medicines Company and its siRNA-based therapy inclisiran for $9.7 billion. (Read more about the interesting story of inclisiran and The Medicines Company’s leap of faith in betting the entire company on inclisiran’s potential here.) The investment showed promise when in 2021, the FDA approved inclisiran—shown to reduce levels of low-density lipoprotein cholesterol (LDL-C) in patients with atherosclerotic cardiovascular diseases and familial hypercholesterolemia. This approval is the first positive payout, although it will take quite some time for the full investment to be recouped.

Novo Nordisk entered a research collaboration with Dicerna Pharmaceuticals in 2019 to discover and develop siRNA-based therapeutics using Dicerna’s proprietary GalXC platform that enables specific targeting of the liver and other tissues, and in 2021, Novo Nordisk announced the acquisition of Dicerna Pharmaceuticals for $3.3 billion.

Also, in 2021, GlaxoSmithKline (GSK) announced they were partnering with Arrowhead Pharmaceuticals. The collaboration would see GSK exclusively develop and commercialize ARO-HSD, a potential RNAi treatment for patients with liver diseases such as non-alcoholic steatohepatitis (NASH).

Roche and Alnylam announce partnership to co-commercialize hypertension siRNA

More recently, on July 24, Alnylam announced it was entering into a strategic agreement with Roche to collaborate on the development and commercialization of zilebesiran. This investigational RNAi therapeutic holds immense potential for treating hypertension, a prevalent cardiovascular condition affecting over 1.2 billion patients worldwide. The collaboration brings together Alnylam’s expertise in RNAi therapeutics and Roche’s global commercial reach and track record of developing novel therapies and it could transform the landscape for patients with severe cardiovascular diseases.

As part of the agreement, Roche will pay Alnylam $310 million upfront and support the development, regulatory, and sales milestones. Upon successful drug launch, both companies will co-market zilebesiran in the U.S., while Roche will have exclusive rights to commercialize the therapeutic outside the U.S. This arrangement ensures a significant impact on patients living with hypertension globally, with Alnylam receiving up to low double-digit royalties on net overseas sales.

The Phase I study of zilebesiran demonstrated its superiority to placebo in reducing angiotensinogen levels in a dose-dependent manner (2). Additionally, patients receiving a dose of at least 200 mg experienced durable blood pressure reduction over 24 hours, lasting up to six months. These results offer a strong foundation for further clinical development and regulatory submissions.

The strategic partnership between Alnylam and Roche represents a significant milestone in advancing the development and commercialization of zilebesiran, an innovative RNAi therapeutic for hypertension. The potential success of zilebesiran holds promise not only for the companies involved but also for the millions of patients worldwide seeking effective solutions for hypertension and related conditions.

Novartis acquisition of DTx for siRNA rare disease neuro pipeline

Novartis is also back in the field of RNAi technology. In a deal intended to strengthen Novartis’s neuroscience pipeline and capabilities in RNA therapeutics, the company announced on July 17 that it had acquired DTx Pharma for $1 billion, with half paid upfront and the potential of the remaining amount in milestone payments.

DTx Pharma focuses on RNA-based therapeutics and has created a proprietary platform called Fatty Acid Ligand Conjugated OligoNucleotide (FALCON) designed to overcome the challenges of delivering RNA-based therapeutics to tissues beyond the liver. By conjugating siRNAs to naturally occurring fatty acids, FALCON enhances biodistribution and cellular uptake throughout the body.

The acquisition grants Norvatis access to the FALCON platform and DTx’s lead pipeline candidate, DTx-1252, a product designed to treat the underlying genetic cause of Charcot-Marie Tooth Disease Type1A (CMT1A). CMT1A is a progressive neuromuscular disease that causes life-long loss of muscle function and disability and affects an estimated 150,000 patients in the United States and Europe.

CMT1A results from the overexpression of peripheral myelin protein 22 (PMP22), which causes abnormal functioning of the myelin sheath that insulates the nerves in the peripheral nervous system. According to a press release from DTx Pharma, DTx-1252 decreases the expression of PMP22 and induces the demyelination of axons to normal levels, thus increasing muscle mass, grip strength, coordination, and agility. Clinical trials for the drug could start in late 2023 or early 2024.

“I am thrilled that Novartis will be moving forward with our CMT1A therapeutic program and the FALCON platform. With its resources and capabilities in neuromuscular diseases, Novartis is well positioned to accelerate the development of DTx-1252 and provide hope to patients, who are desperately in need of therapy,” said Artie Suckow, co-founder and CEO of DTx Pharma.

Robert H. Baloh, MD, Ph.D., head of neuroscience at the Novartis Institutes for BioMedical Research (NIBR), said that Novartis would love to expand the use of FALCON to create treatments for neuro diseases with larger patient populations, like amyotrophic lateral sclerosis (ALS), Alzheimer’s disease, and Parkinson’s disease.

Also expanding the Novartis pipeline are two other DTx preclinical programs said to have “highly encouraging” preclinical data. The diseases these therapeutics target remain undisclosed.

“We look forward to continuing the development of DTx’s therapeutic programs and bringing new hope to patients with neuromuscular and other neurological disorders for which there have historically been few treatment options,” said Fiona Marshall, president of the Novartis Institutes for BioMedical Research, in the Novartis press release. “We are also excited to bring DTx’s FALCON technology to Novartis and explore its potential to deliver drugs to extrahepatic tissues.”

DTx is the second rare disease drug developer Novartis has purchased this year, with Chinook Therapeutics acquired in June for up to $3.5 billion. Chinook’s supply includes two Phase III candidates targeting rare kidney disease Immunoglobulin A Nephropathy (IgAN).

The future of RNAi therapies

According to a 2022 survey by consulting firm CRB Horizons, industry respondents reported they either plan to or already have made significant investments in the short term in new RNA manufacturing capacity and intend to invest a substantial proportion toward large-scale production of RNA products. Over the last two decades, the pharmaceutical industry’s turbulent perspective of RNAi technology has made success challenging. However, scientists and companies that believed in the therapy doggedly pursued their research and found solutions to the challenges that had initially spurred companies away. Now, RNAi technology represents a new way to treat diseases, and with the confidence of more companies investing in the technology, it has the potential to bring hope to patients living with conditions once believed to be untreatable.

References:

- Haussecker D. The Business of RNAi Therapeutics in 2012. Mol Ther Nucleic Acids. 2012 Feb 7;1(2):e8. doi: 10.1038/mtna.2011.9. PMID: 23344723; PMCID: PMC3381602.

- Desai AS, Webb DJ, Taubel J, Casey S, Cheng Y, Robbie GJ, Foster D, Huang SA, Rhyee S, Sweetser MT, Bakris GL. Zilebesiran, an RNA Interference Therapeutic Agent for Hypertension. N Engl J Med. 2023 Jul 20;389(3):228-238. doi: 10.1056/NEJMoa2208391. PMID: 37467498.

“The views, opinions, findings, and conclusions or recommendations expressed in these articles and highlights are strictly those of the author(s) and do not necessarily reflect the views of the Oligonucleotide Therapeutics Society (OTS). OTS takes no responsibility for any errors or omissions in, or for the correctness of, the information contained in these articles. The content of these articles is for the sole purpose of being informative. The content is not and should not be used or relied upon as medical, legal, financial, or other advice. Nothing contained on OTS websites or published articles/highlights is intended by OTS or its employees, affiliates, or information providers to be instructional for medical diagnosis or treatment. It should not be used in place of a visit, call, consultation, or the advice of your physician or other qualified health care provider. Always seek the advice of your physician or qualified health care provider promptly if you have any healthcare-related questions. You should never disregard medical advice or delay in seeking it because of something you have read on OTS or an affiliated site.”